Traders sell their own NFT themselves to increase prices

The NFT marketplace is full of people who buy their own NFT to increase prices, according to a report released this week by the Blockchain data company chain. Known as “Wash Trading”, the action of buying and selling security to deceive the market ever used on Wall Street, and has been illegal for almost a century. But the extensive and non-regulated NFT market has proven to be a golden opportunity for scammers.

The report tracks examples of the same traders by selling the same NFT back and forth at least 25 times, the possibility of a washing trade incident. It identifies a group of NFT 110 washing traders who have made a profit of around $ 8.9 million from this practice. The researchers also found significant evidence of money laundering in the NFT market in the last half of 2021. Values sent to the NFT market with addresses related to fraud side by side significantly in the third quarter of 2021, worth more than $ 1 million Cryptocurrency, according to reports. About $ 1.4 million sales dollars in the fourth quarter of 2021 came from the prohibited address.

“NFT washing trade is in a gloomy legal area. While Wash Trading is prohibited in conventional securities and future, washing trade involving NFFTs has not become the subject of enforcement action,” said the report author.

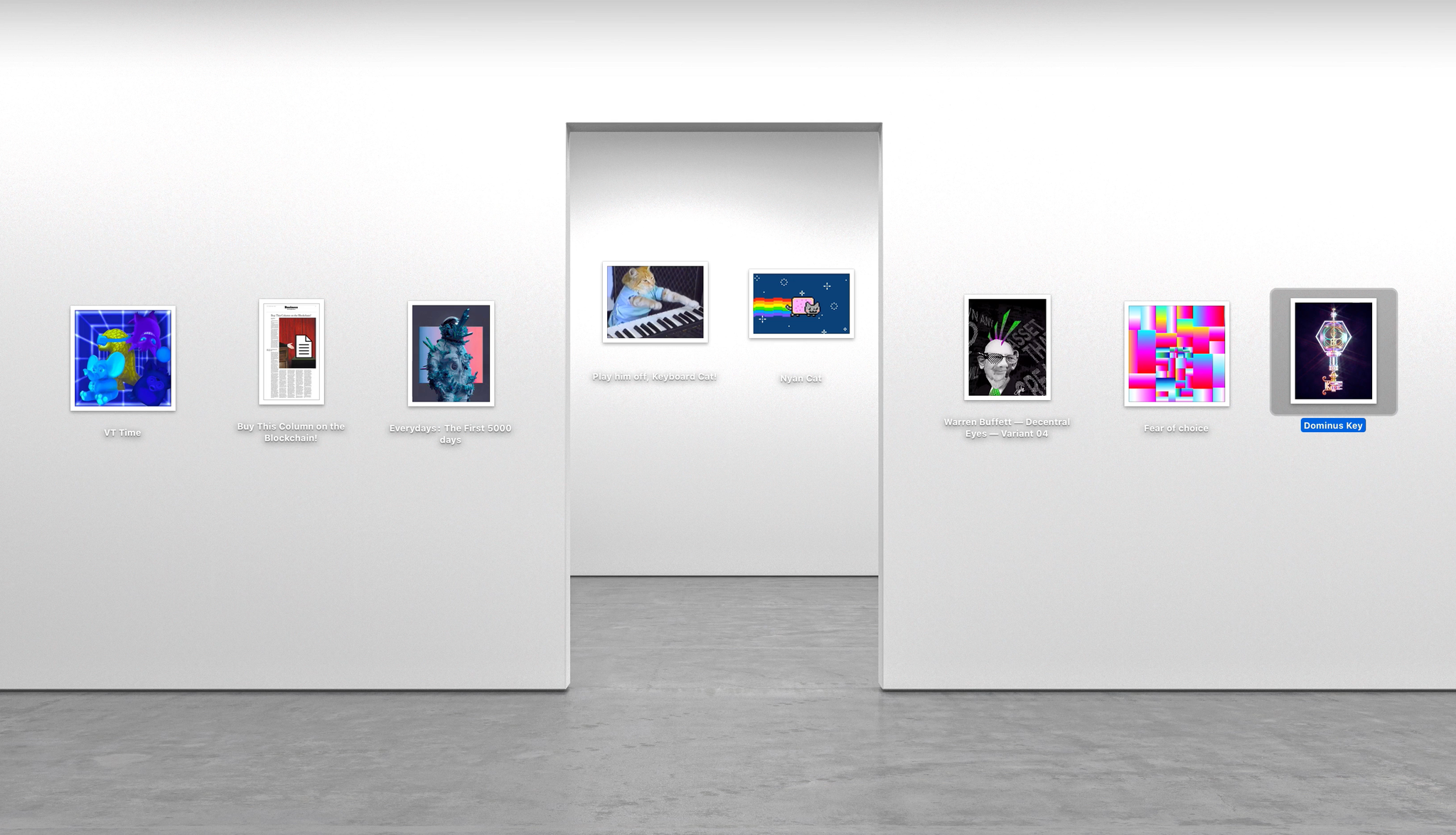

NFTS, or non-fungible tokens, is a new class of digital tokens assets in Blockchain and mainly purchased with Ethereum, the form of cryptocurrency. The Crypto collection can consist of anything from two-dimensional images to GIF to the song. The NFT market is estimated to be worth between $ 7 billion to $ 44.2 billion. Digital assets skyrocketed popularity in 2021, and have been embedded by celebrities such as Mark Cuban, Tom Brady, and Reese Witherspoon.

Skeptical has questioned the legitimacy and needs of NFTS because the relatively new space surged in popularity. High profile NFT sales, such as a $ 69 million record last year from the Beeple artist collection, has become more frequently. But because digital tokens are not security, they are not subject to the same US laws and regulations that regulate shares, for example. A number of fraud has appeared in the NFT room in recent months, including fake NFT and money laundering.

You may also like

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Leave a Reply